Motivation

This blog is the second one of my 3 blogs about VAR model. In this blog, I will introduce how to use Stata’s integrated commands var and svar to estimate the VAR model, which is also the common practices for researchers in VAR estimation. While it has little incremental value to an extant blog Vector autoregressions in Stata written by David Schenck, this blog will serve as an important benchmark for my manual calculations of all the major VAR estimation outputs in the next blog.

Sample Dataset

The dataset used in this blog is a shipped dataset named varsample.dta. It can be accessed here. This dataset collects the quarterly times series of U.S. unemployment rate unrate, rate of consumer price inflation inflation, and short-term nominal interest rate (federal funds rate) ffr from 1968 to 2018.

1

2

3

4

5

6

7

8

9

10

11

12

|

. use varsample.dta, clear

. list in 1/5

+---------------------------------------------------------+

| n_date date ffr inflat~n unrate yq |

|---------------------------------------------------------|

1. | 1968-01-01 1968-01-01 4.5 -.659 3.7 32 |

2. | 1968-04-01 1968-04-01 5.5 -.656 3.5 33 |

3. | 1968-07-01 1968-07-01 6.13 -.651 3.7 34 |

4. | 1968-10-01 1968-10-01 6 -.647 3.4 35 |

5. | 1969-01-01 1969-01-01 4 -.643 3.4 36 |

+---------------------------------------------------------+

|

Set time series (tsset or xtset)

The prerequisite for var and svar is a well-defined consecutive time series. As the sample data is not panel data, I use tsset to do that. The consecutive quarterly time series variable in this dataset is yq.

1

2

3

4

|

. tsset yq

Time variable: yq, 32 to 235

Delta: 1 unit

|

Determine the time lag (varsoc)

I use varsoc command to run the lag-order selection. One can help varsoc to learn more details about the selection method. Both the likelihood ratio test and Akaike’s information criterion (AIC) recommend 7 lags, which I use through the rest of this post.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

|

. varsoc inflation unrate ffr, maxlag(8)

Lag-order selection criteria

Sample: 40 thru 235 Number of obs = 196

+---------------------------------------------------------------------------+

| Lag | LL LR df p FPE AIC HQIC SBIC |

|-----+---------------------------------------------------------------------|

| 0 | -1063.21 10.6553 10.8797 10.9 10.9299 |

| 1 | 170.566 2467.6 9 0.000 .00004 -1.61802 -1.53676 -1.41732 |

| 2 | 217.394 93.657 9 0.000 .000027 -2.00402 -1.86183 -1.6528 |

| 3 | 246.843 58.898 9 0.000 .000022 -2.21269 -2.00955* -1.71094* |

| 4 | 253.46 13.233 9 0.152 .000023 -2.18837 -1.92429 -1.53609 |

| 5 | 261.64 16.359 9 0.060 .000023 -2.18 -1.85498 -1.37719 |

| 6 | 273.936 24.593 9 0.003 .000022 -2.21363 -1.82768 -1.2603 |

| 7 | 285.311 22.751* 9 0.007 .000021* -2.23787* -1.79098 -1.13401 |

| 8 | 289.68 8.7374 9 0.462 .000023 -2.19061 -1.68278 -.936231 |

+---------------------------------------------------------------------------+

* optimal lag

Endogenous: inflation unrate ffr

Exogenous: _cons

|

Estimate the VAR system (var or svar)

Having decided that the 7 lags are appropriate for this VAR, we can use either var or svar command to estimate the coefficients of the VAR. Theoretically we need to decide whether the VAR system is stable before the VAR estimation but we can usually skip this step because the VAR estimation would not converge if the system were not stable.

var command

The var command and results are as follows.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

|

. var inflation unrate ffr, lags(1/7)

Vector autoregression

Sample: 39 thru 235 Number of obs = 197

Log likelihood = 288.0632 AIC = -2.254449

FPE = .0000211 HQIC = -1.809178

Det(Sigma_ml) = .0000108 SBIC = -1.154492

Equation Parms RMSE R-sq chi2 P>chi2

----------------------------------------------------------------

inflation 22 .008897 0.9998 1187611 0.0000

unrate 22 .283532 0.9710 6591.751 0.0000

ffr 22 1.64854 0.8694 1311.053 0.0000

----------------------------------------------------------------

------------------------------------------------------------------------------

| Coefficient Std. err. z P>|z| [95% conf. interval]

-------------+----------------------------------------------------------------

inflation |

inflation |

L1. | 1.16245 .0715051 16.26 0.000 1.022302 1.302597

L2. | -.384423 .1084028 -3.55 0.000 -.5968886 -.1719573

L3. | .3306758 .1089644 3.03 0.002 .1171096 .544242

L4. | -.1980314 .1101572 -1.80 0.072 -.4139356 .0178728

L5. | .2570946 .1089103 2.36 0.018 .0436344 .4705548

L6. | -.0861371 .1081372 -0.80 0.426 -.298082 .1258079

L7. | -.0796988 .0716629 -1.11 0.266 -.2201555 .060758

|

unrate |

L1. | -.0070429 .0023144 -3.04 0.002 -.0115791 -.0025067

L2. | .007192 .0037463 1.92 0.055 -.0001506 .0145345

L3. | .0021743 .0037601 0.58 0.563 -.0051954 .009544

L4. | .0024686 .0038336 0.64 0.520 -.0050451 .0099824

L5. | -.0096445 .0036164 -2.67 0.008 -.0167326 -.0025565

L6. | .0085564 .0037105 2.31 0.021 .001284 .0158289

L7. | -.0038481 .0022014 -1.75 0.080 -.0081629 .0004666

|

ffr |

L1. | .0000775 .000391 0.20 0.843 -.0006889 .0008439

L2. | .0009212 .0004199 2.19 0.028 .0000982 .0017442

L3. | .0007338 .0004222 1.74 0.082 -.0000936 .0015612

L4. | .0005146 .0004459 1.15 0.248 -.0003593 .0013884

L5. | -.0007561 .0004095 -1.85 0.065 -.0015587 .0000466

L6. | -.0002788 .0004089 -0.68 0.495 -.0010803 .0005227

L7. | -.0008528 .0003889 -2.19 0.028 -.0016149 -.0000906

|

_cons | .0070745 .0031262 2.26 0.024 .0009471 .0132018

-------------+----------------------------------------------------------------

unrate |

inflation |

L1. | -1.231156 2.278772 -0.54 0.589 -5.697468 3.235156

L2. | 3.443442 3.454654 1.00 0.319 -3.327556 10.21444

L3. | -.1066172 3.472549 -0.03 0.976 -6.912689 6.699454

L4. | 1.259347 3.510564 0.36 0.720 -5.621233 8.139927

L5. | -2.66152 3.470825 -0.77 0.443 -9.464212 4.141172

L6. | .8081638 3.446187 0.23 0.815 -5.946239 7.562567

L7. | -1.480169 2.283801 -0.65 0.517 -5.956338 2.995999

|

unrate |

L1. | 1.329821 .0737573 18.03 0.000 1.185259 1.474382

L2. | .0023896 .1193886 0.02 0.984 -.2316077 .2363869

L3. | -.3491413 .1198299 -2.91 0.004 -.5840036 -.1142791

L4. | -.1870338 .1221724 -1.53 0.126 -.4264873 .0524197

L5. | .2609972 .1152507 2.26 0.024 .0351099 .4868844

L6. | -.0892354 .1182482 -0.75 0.450 -.3209976 .1425267

L7. | -.0158381 .0701571 -0.23 0.821 -.1533434 .1216672

|

ffr |

L1. | .0391868 .0124618 3.14 0.002 .0147622 .0636114

L2. | .0133781 .0133815 1.00 0.317 -.0128492 .0396054

L3. | -.0020393 .0134537 -0.15 0.880 -.0284081 .0243295

L4. | -.042115 .0142089 -2.96 0.003 -.0699639 -.0142661

L5. | -.0104107 .0130509 -0.80 0.425 -.0359899 .0151686

L6. | -.0027428 .0130325 -0.21 0.833 -.028286 .0228003

L7. | .0179745 .0123927 1.45 0.147 -.0063148 .0422638

|

_cons | .1227788 .0996293 1.23 0.218 -.072491 .3180486

-------------+----------------------------------------------------------------

ffr |

inflation |

L1. | -4.707449 13.24949 -0.36 0.722 -30.67598 21.26108

L2. | 14.62629 20.08643 0.73 0.467 -24.7424 53.99498

L3. | -13.79702 20.19048 -0.68 0.494 -53.36964 25.7756

L4. | 18.50689 20.41152 0.91 0.365 -21.49894 58.51273

L5. | -8.194952 20.18046 -0.41 0.685 -47.74792 31.35802

L6. | 14.6829 20.03721 0.73 0.464 -24.5893 53.95511

L7. | -22.07114 13.27873 -1.66 0.096 -48.09697 3.954702

|

unrate |

L1. | -2.044818 .428848 -4.77 0.000 -2.885345 -1.204291

L2. | 1.542331 .6941623 2.22 0.026 .1817982 2.902864

L3. | .4599863 .6967282 0.66 0.509 -.9055759 1.825548

L4. | .2812749 .7103485 0.40 0.692 -1.110983 1.673532

L5. | .3858028 .6701035 0.58 0.565 -.9275758 1.699181

L6. | -1.11061 .6875317 -1.62 0.106 -2.458148 .2369271

L7. | .4463692 .4079151 1.09 0.274 -.3531296 1.245868

|

ffr |

L1. | .2870547 .0724567 3.96 0.000 .1450422 .4290672

L2. | .1779213 .0778042 2.29 0.022 .0254279 .3304148

L3. | .4496412 .0782241 5.75 0.000 .2963247 .6029577

L4. | .2517726 .0826149 3.05 0.002 .0898503 .4136949

L5. | .0537564 .0758819 0.71 0.479 -.0949694 .2024823

L6. | -.1680117 .0757748 -2.22 0.027 -.3165276 -.0194959

L7. | -.2284582 .0720552 -3.17 0.002 -.3696838 -.0872326

|

_cons | 1.077793 .5792758 1.86 0.063 -.057567 2.213152

------------------------------------------------------------------------------

|

svar command

One can find the precise specifications of this command in the handbook (p. 7) of Stata’s svar command (see in this link). The handbook also mentioned that one can manually add constraints to the SVAR model. In particular, one way to impose the Cholesky restrictions, which are by default used in the var command, is to specify the aeq and beq matrix as the following format.

$$

\mathbf{aeq}=\left[\begin{array}{lll}

1 & 0 & 0 \\\

\cdot & 1 & 0 \\\

\cdot & \cdot & 1

\end{array}\right] \quad \text { and } \quad \mathbf{beq}=\left[\begin{array}{ccc}

\cdot & 0 & 0 \\\

0 & . & 0 \\\

0 & 0 & \cdot

\end{array}\right]

$$

For me, the biggest incremental value of svar command to the var command is that it can automatically produce the estimation of the contemporaneous effects matrix A in the following structural-form VAR.

$$

Ax_t=\nu+\Sigma_{i=1}^{p}\Gamma_i x_{t-i}+e_t

$$

To be exact, the svar model stores the estimation of the matrix \(A\) in a matrix called e(A). With this matrix \(A\) , one can recover the structural shocks \(\epsilon_t\) and its covariance matrix \(\Sigma_\epsilon\) from reduced-form residuals \(e_t\) via \(\epsilon_t=Ae_t\) and \(\Sigma_\epsilon= A\Sigma_eA’\).

I skipped some details to be brief, readers who would like to dig deeper can find more details in Stata’s svar command handbook (see in this link). The svar command and results are as follows.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

|

. matrix A1 = (1,0,0 \ .,1,0 \ .,.,1)

. matrix B1 = (.,0,0 \ 0,.,0 \ 0,0,.)

. svar inflation unrate ffr, lags(1/7) aeq(A1) beq(B1)

Estimating short-run parameters

Iteration 0: log likelihood = -785.35924

Iteration 1: log likelihood = -217.78432

Iteration 2: log likelihood = 129.49698

Iteration 3: log likelihood = 277.75696

Iteration 4: log likelihood = 287.7111

Iteration 5: log likelihood = 288.06267

Iteration 6: log likelihood = 288.06322

Iteration 7: log likelihood = 288.06322

Structural vector autoregression

( 1) [/A]1_1 = 1

( 2) [/A]1_2 = 0

( 3) [/A]1_3 = 0

( 4) [/A]2_2 = 1

( 5) [/A]2_3 = 0

( 6) [/A]3_3 = 1

( 7) [/B]1_2 = 0

( 8) [/B]1_3 = 0

( 9) [/B]2_1 = 0

(10) [/B]2_3 = 0

(11) [/B]3_1 = 0

(12) [/B]3_2 = 0

Sample: 39 thru 235 Number of obs = 197

Exactly identified model Log likelihood = 288.0632

------------------------------------------------------------------------------

| Coefficient Std. err. z P>|z| [95% conf. interval]

-------------+----------------------------------------------------------------

/A |

1_1 | 1 (constrained)

2_1 | 2.838578 2.261524 1.26 0.209 -1.593927 7.271083

3_1 | -31.31379 12.54682 -2.50 0.013 -55.90511 -6.72248

1_2 | 0 (constrained)

2_2 | 1 (constrained)

3_2 | 1.510951 .3937039 3.84 0.000 .7393057 2.282597

1_3 | 0 (constrained)

2_3 | 0 (constrained)

3_3 | 1 (constrained)

-------------+----------------------------------------------------------------

/B |

1_1 | .0083854 .0004224 19.85 0.000 .0075574 .0092134

2_1 | 0 (constrained)

3_1 | 0 (constrained)

1_2 | 0 (constrained)

2_2 | .2661691 .0134094 19.85 0.000 .2398871 .292451

3_2 | 0 (constrained)

1_3 | 0 (constrained)

2_3 | 0 (constrained)

3_3 | 1.470823 .074099 19.85 0.000 1.325592 1.616055

------------------------------------------------------------------------------

. mat list e(A)

e(A)[3,3]

inflation unrate ffr

inflation 1 0 0

unrate 2.8385778 1 0

ffr -31.313794 1.5109512 1

|

If you’d like, you can list the reduced-form coefficients estimated by the above svar command, which are stored in a matrix named e(bf_var). Unsurprisingly, they are exactly the same as those estimated with var command.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

|

. mat list e(bf_var)

e(bf_var)[1,66]

inflation: inflation: inflation: inflation: inflation: inflation: inflation:

L. L2. L3. L4. L5. L6. L7.

inflation inflation inflation inflation inflation inflation inflation

r1 1.1624496 -.38442299 .33067581 -.19803137 .25709458 -.08613706 -.07969876

inflation: inflation: inflation: inflation: inflation: inflation: inflation:

L. L2. L3. L4. L5. L6. L7.

unrate unrate unrate unrate unrate unrate unrate

r1 -.00704289 .00719199 .00217432 .00246865 -.00964455 .00855645 -.00384815

inflation: inflation: inflation: inflation: inflation: inflation: inflation:

L. L2. L3. L4. L5. L6. L7.

ffr ffr ffr ffr ffr ffr ffr

r1 .0000775 .00092119 .00073382 .00051456 -.00075606 -.00027879 -.00085278

inflation: unrate: unrate: unrate: unrate: unrate: unrate:

L. L2. L3. L4. L5. L6.

_cons inflation inflation inflation inflation inflation inflation

r1 .00707448 -1.2311559 3.4434415 -.10661715 1.2593467 -2.6615204 .80816382

unrate: unrate: unrate: unrate: unrate: unrate: unrate:

L7. L. L2. L3. L4. L5. L6.

inflation unrate unrate unrate unrate unrate unrate

r1 -1.4801693 1.3298207 .00238958 -.34914135 -.18703379 .26099715 -.08923544

unrate: unrate: unrate: unrate: unrate: unrate: unrate:

L7. L. L2. L3. L4. L5. L6.

unrate ffr ffr ffr ffr ffr ffr

r1 -.0158381 .0391868 .0133781 -.0020393 -.04211502 -.01041068 -.00274284

unrate: unrate: ffr: ffr: ffr: ffr: ffr:

L7. L. L2. L3. L4. L5.

ffr _cons inflation inflation inflation inflation inflation

r1 .01797453 .12277881 -4.7074491 14.62629 -13.797021 18.506895 -8.1949518

ffr: ffr: ffr: ffr: ffr: ffr: ffr:

L6. L7. L. L2. L3. L4. L5.

inflation inflation unrate unrate unrate unrate unrate

r1 14.682903 -22.071136 -2.0448181 1.5423312 .45998626 .28127488 .38580282

ffr: ffr: ffr: ffr: ffr: ffr: ffr:

L6. L7. L. L2. L3. L4. L5.

unrate unrate ffr ffr ffr ffr ffr

r1 -1.1106103 .44636919 .28705469 .17792134 .44964119 .2517726 .05375644

ffr: ffr: ffr:

L6. L7.

ffr ffr _cons

r1 -.16801173 -.22845819 1.0777927

|

Obtain IRFs, OIRFs, and Variance Decomposition (irf create)

All the IRFs, OIRFs, and Variance Decomposition results can be conveniently obtained withirf create command. For example, the following command will create a file named myirf.irf to store the 15-step forward-looking impulse response functions (IRFs), orthogonalized IRFs (OIRFs), structural IRFs (SIRFs), cumulative IRFs (CIRFs), forecast-error variance decomposition (FEVD), etc. In this file, all these results are tagged to belong to the VAR estimation named forblog. You can change the parameters as you like following the syntax documented in this link.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

|

. irf create forblog, step(15) set(myirf) replace

(file myirf.irf created)

(file myirf.irf now active)

irfname forblog not found in myirf.irf

(file myirf.irf updated)

. preserve

. use myirf.irf, replace

. format *irf %6.0g

. list impulse response step irf cirf oirf sirf fevd in 19/27 ,noob

+------------------------------------------------------------------------------+

| impulse response step irf cirf oirf sirf fevd |

|------------------------------------------------------------------------------|

| inflation inflation 2 .9752 3.138 .0087 .0087 .9789 |

| unrate inflation 2 -.0105 -.0176 -.0031 -.0031 .02103 |

| ffr inflation 2 7.6e-04 8.4e-04 .0011 .0011 7.5e-05 |

| inflation unrate 2 .1906 -1.041 -.016 -.016 .00781 |

| unrate unrate 2 1.699 4.029 .4215 .4215 .97471 |

|------------------------------------------------------------------------------|

| ffr unrate 2 .0766 .1158 .1127 .1127 .01748 |

| inflation ffr 2 10.32 5.613 .1814 .1814 .03232 |

| unrate ffr 2 -1.731 -3.776 -.533 -.533 .19658 |

| ffr ffr 2 .1798 1.467 .2645 .2645 .7711 |

+------------------------------------------------------------------------------+

. restore

|

Visualization and Interpretation (irf table and irf graph)

You may visualize these outputs by listing tables or draw figures as you like.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

|

. irf graph oirf, impulse(inflation unrate ffr) response(inflation unrate ffr) yline(0,lcolor(black)) xlabel(0(5)15) byopts(yrescale)

. irf table oirf, impulse(inflation unrate ffr) response(inflation) noci

Results from forblog

-------------------------------------------

| (1) (2) (3)

Step | oirf oirf oirf

---------+---------------------------------

0 | .008385 0 0

1 | .009938 -.001906 .000114

2 | .008654 -.003105 .001114

3 | .009175 -.003778 .002361

4 | .009006 -.003715 .00351

5 | .009924 -.005065 .003886

6 | .011327 -.005197 .004351

7 | .011165 -.005552 .004475

8 | .011152 -.00589 .004739

9 | .011371 -.005636 .005334

10 | .011507 -.005857 .005339

11 | .011784 -.0058 .005251

12 | .011916 -.005575 .005234

13 | .011872 -.005392 .005132

14 | .011874 -.004973 .005162

15 | .011933 -.00466 .005074

-------------------------------------------

(1) irfname = forblog, impulse = inflation, and response = inflation.

(2) irfname = forblog, impulse = unrate, and response = inflation.

(3) irfname = forblog, impulse = ffr, and response = inflation.

|

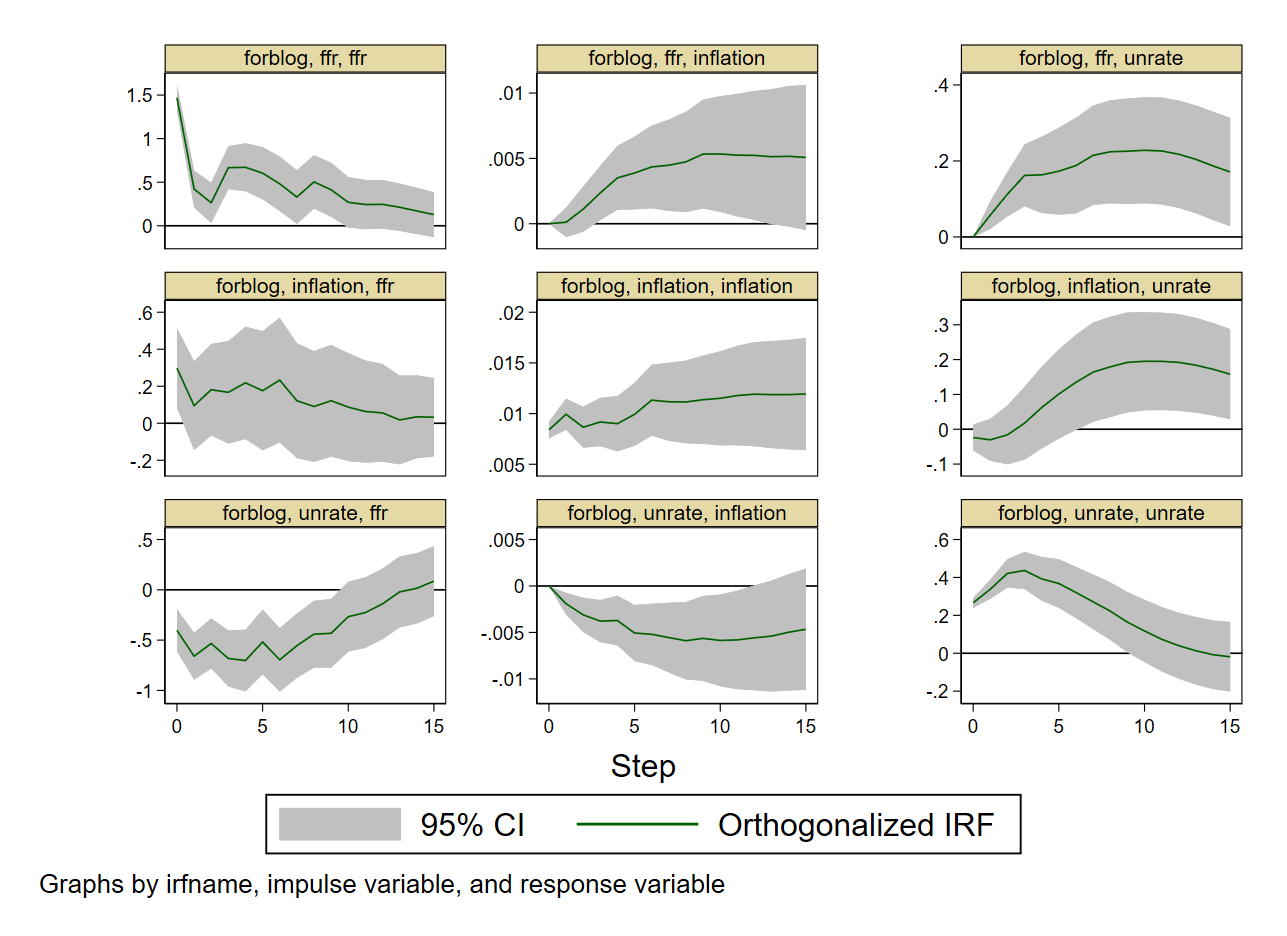

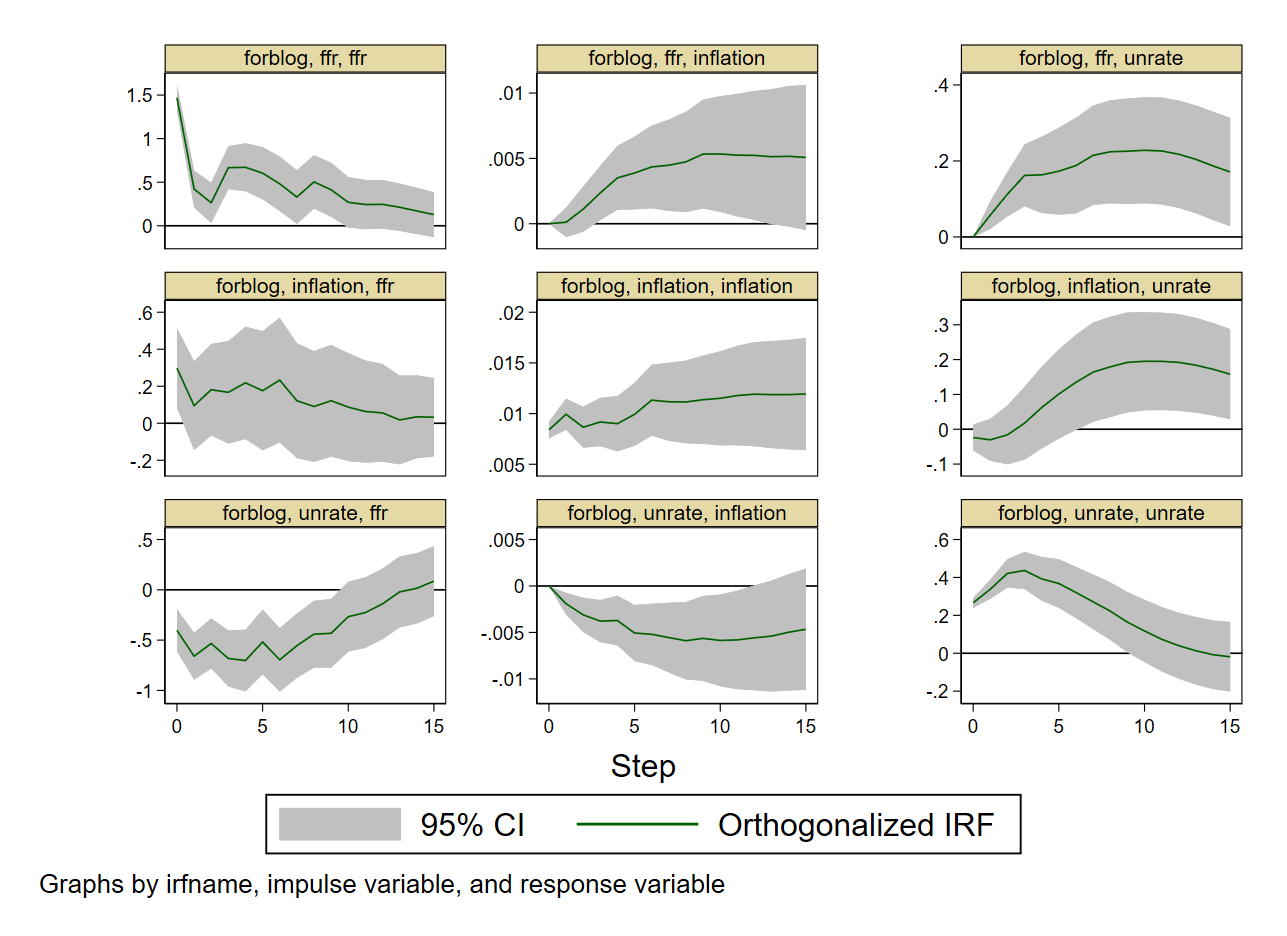

The following graph displays the orthogonalized IRFs in the 15-step forward-looking timeframe. For each subfigure, there are three names in the head. They are the VAR estimation frame title, the impulse shock name, and the response equation name. Fort example, the figure in row 2 and column 3 displays the 15-step forward-looking response of unemployment rate (unrate) to the shock from inflation (inflation). It suggests that the unexpected shock from inflation triggers persistent elevated unemployment rate and this trend sustained over 15 quarters after the shock happened.

Figure 1: Graphs for Orthogonalized IRFs

Integrated Codes

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

|

* load data

sysuse varsample.dta, clear

* set time series

tsset yq

* choose lag orders

varsoc inflation unrate ffr, maxlag(8)

* estimate VAR using `var' command

var inflation unrate ffr, lags(1/7)

* estimate VAR using `svar' command

matrix A1 = (1,0,0 \ .,1,0 \ .,.,1)

matrix B1 = (.,0,0 \ 0,.,0 \ 0,0,.)

svar inflation unrate ffr, lags(1/7) aeq(A1) beq(B1)

* crete output dataset myirf.irf

irf create forblog, step(15) set(myirf) replace

* visualize irfs

irf graph oirf, impulse(inflation unrate ffr) response(inflation unrate ffr) yline(0,lcolor(black)) xlabel(0(5)15) byopts(yrescale)

irf table oirf, impulse(inflation unrate ffr) response(inflation) noci

|

Summary

In this blog, I show how to use the integrated order var and svar to produce stylized outputs of VAR estimation in Stata. They will be benchmarks for the next blog where I will manually replicate all these results in Stata to obtain deeper understanding about these outputs.

References

- Vector autoregressions in Stata by David Schenck

- Stata handbook on svar command